What Are My Mileage Tracking Options?

The Hurdlr app keeps track of your mileage, invoices, receipts, and different documentation. To guarantee your mileage is prepared to be tracked precisely, make certain to examine the optimal settings as outlined right here. We totally test dozens of apps, websites, and aspect hustle concepts to discover the highest money-making strategies. We additionally rely on secondary research and knowledge alongside our hands-on evaluations.

How To Make Money With Pod Web Sites – Promoting Art Online

- Creating a tax profile entails choosing your state, the suitable state and federal submitting status, and wage.

- Timeero tracks the reps’ journey and segments it based on stops taken.

- Additionally, Hurdlr’s API can even hook up with cost platforms like PayPal, Sqaure, Freshbooks, and Uber to observe any side hustle income you are making.

- After stopping the tracker, the journey you tracked will be mechanically tagged as Business.

- The app attributes the mileage it tracks to the job/task the employee clocked in for.

All unclassified drives are listed underneath “New” on cellular gadgets, whereas classified drives are in the “Reviewed” column. You swipe the drive card left to tag it as private or right for enterprise journeys. On the web portal, choose a drive and click on on “tag as business” or “tag as personal” to categorise it accordingly. TripLog and Mile IQ are related mileage tracking services for each people and small groups.

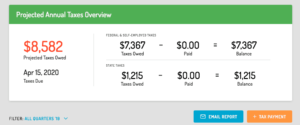

Detailed Federal, State And Self-employed Tax Estimates

I love the mileage tracker that lets me enter my working hours so it solely asks me to tag the important business drives. It is doable to keep a small handbook mileage log, but frequent and long-distance drivers can generally lose monitor. In this video, you may find out about tips on how to use Hurdlr’s mileage monitoring options to remain on top of monitoring this useful tax deduction. It keeps monitor of all the monetary data you have to know working a enterprise – expenses, revenue, and mileage. To ensure your mileage is tracked, evaluate the optimum settings that Hurdlr wants to trace your trips correctly.

If you’re constantly taking clients out for lunch or driving to house viewings as an actual property agent, Hurdlr could be a good way to log your whole bills. Hurdlr is a free app that works on a ‘freemium’ model, that means some of their features are locked behind a paid subscription. Nonetheless, each the free and paid version of the app are pretty stable.

As a result, you would possibly miss components of your journeys, such as when driving on rough roads or slow-moving visitors hurdlr review. While there isn’t a free version of Mile IQ, customers can strive a trial of the person model free of charge. To sum it up, Fyle is best for large companies, and there’s no free version. Let’s examine Hurdlr to another rivals in the business by primarily looking at the features they provide. There are 1000’s of small enterprise types, and never all house owners are trained for intense accounting. When your client transactions are over, the API routinely hyperlinks your financial institution deposits with every invoice, maintaining your figures clean and organized.

Android users should also evaluate these Android particular settings to ensure your gadget permits Hurdlr to run within the background and observe your mileage. If you employ a CPA (certified public accountant) you can even e mail Hurdlr reviews to them to make life simpler for everybody involved. Plus, you can also e-mail yourself reviews or month-to-month breakdowns of your earnings and bills to watch how your corporation or side hustle is doing.

With so many issues taking place in the course of the workday, some drives might slip via the cracks, denying you the rightful tax deductions or reimbursement. In the automatic tracking mode, Hurdlr makes use of drive detection expertise. The telephone’s accelerometer routinely logs miles when the automobile is moving and stops tracking when the automobile is stationary or after several minutes of inactivity. Timeero tracks mileage precisely to enhance worker reimbursement and tax deductions.

The Most Effective Uber Driver Recommendation You Can Get In Under An Hour

If you’re in search of a wise method to observe your car mileage, you may need heard of MileIQ. The function suggests the shortest route to a vacation spot based on your previous drives. Making Certain employees take the shortest route shaves a couple of miles off their log, which might result in colossal gas cost savings. The app also enables you to set up a tax profile to see your real-time tax estimates.

The app additionally generates detailed expense reports with receipts, which you can e mail on to your tax preparer. This all-in-one solution combines receipt monitoring, enterprise tax calculations, and mileage logging into a single, user-friendly app. Hurdlr is a mileage tracking app geared toward serving to solopreneurs, freelancers, and rideshare drivers stay on top of their earnings and bills. If you’re contemplating this app and are wondering whether or not it fits your needs and preferences, we took the app for a spin to discover its strengths and weaknesses.

Reach out by way of e mail at email protected, join on Fb at facebook.com/hurdlr, or visit hurdlr.com for extra assist. The developer, Hurdlr, Inc., indicated that the app’s privacy practices could include dealing with of data as described below. Nonetheless, know that if you try Hurdlr, you might not have the power to https://www.quickbooks-payroll.org/ get everything it advertises with a premium subscription. As a outcome, it doesn’t swimsuit someone who prefers a fully-automatic one-stop API for work-related figures. Total, Fyle has more banking-related features similar to card administration, fraud detection, and multi-currency assist.

Plus, automating these processes will save you time and aggravation, which can additionally be valuable. Sure, Hurdlr has an automated mileage tracker that logs mileage routinely for accurate tax deductions and reimbursements. If you have to observe expenses, or may gain advantage from this sooner or later, then undoubtedly Hurdlr is the better choice for you, as MileIQ just tracks miles. Hurdlr’s automatic expense tracker will prevent extra time and money, and make tax deductions or expense reimbursements a breeze. The app also allows you to set work hours or time frames when it should monitor mileage to simplify drive classification.